Max Amount 401k 2025

Max Amount 401k 2025. Employers can only use the first $345,000 of compensation to determine your 401. Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2025 and 2025.

While you can save quite a lot in a 401 (k) every year, you can’t contribute an unlimited. Most people don’t max out their 401(k).

The total maximum allowable contribution to a defined contribution plan (including both employee and employer contributions) is expected to.

The Maximum 401k Contribution Limit Financial Samurai, Determine your balance at retirement with this free 401 (k) calculator. The total maximum allowable contribution to a defined contribution plan (including both employee and employer contributions) is expected to.

What’s the Maximum 401k Contribution Limit in 2025? (2025), Max solo roth 401k contribution with less taxes for small business, maximum roth 401k contribution 2025 over 55. $19,500 in 2025 and 2025 and $19,000 in 2019), plus $7,500 in 2025;.

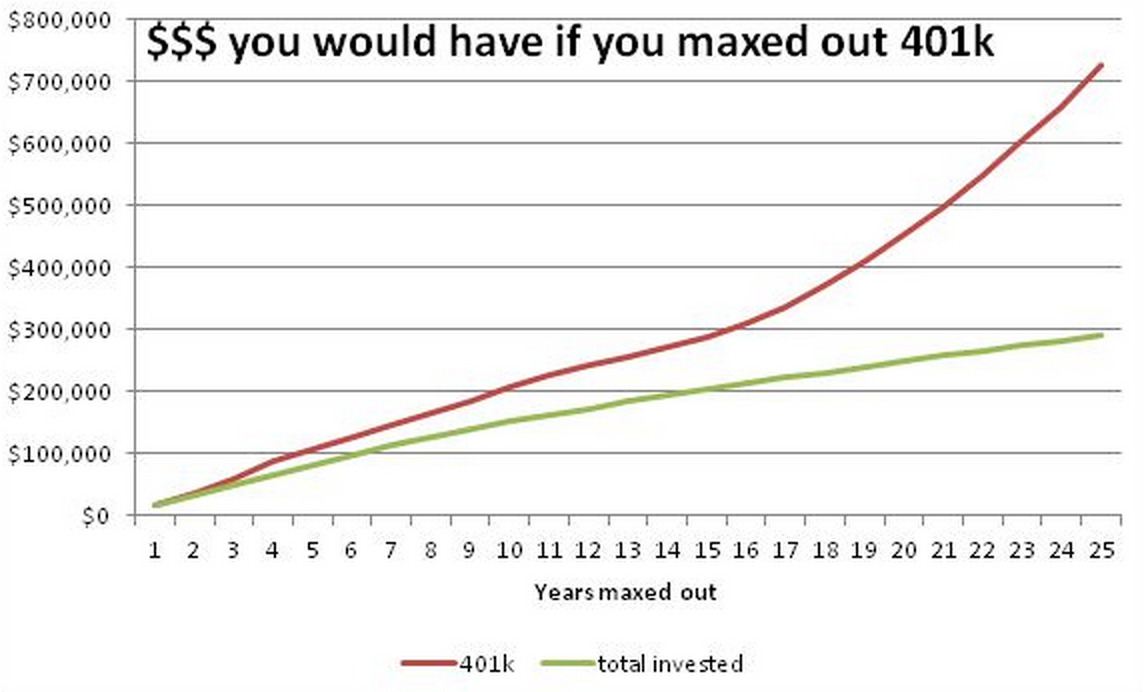

401k Calculator Calculators For All Mobile Friendly, Are you wondering what it would look like to max out your 401(k) contributions for the year? For tax years starting in 2025, an employer may make uniform additional contributions for each simple plan employee to a maximum of the lesser of up to 10% of.

What Percentage Of People Max Out Their 401(k)? Financial Samurai, In 2025, the total contribution limit. Those 50 and older can contribute an additional $7,500 in 2025 and 2025.

What if you always maxed out your 401k, If you contribute, say, $23,000 toward your 401 (k) in 2025 and your employer adds $5,000, you’re still within the irs limits. 48 rows every year, the irs sets the maximum 401.

What if You Always Maxed Out Your 401(k)? Don't Quit Your Day Job…, Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2025 and 2025. Max solo roth 401k contribution with less taxes for small business, maximum roth 401k contribution 2025 over 55.

What is the maximum 401k loan amount? YouTube, Employers can only use the first $345,000 of compensation to determine your 401. Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

The Maximum 401(k) Contribution Limit For 2025, Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025. Those 50 and older can contribute an additional $7,500 in 2025 and 2025.

Max On 401k 2025 Kial Selina, Max roth 401k contribution 2025. Input your monthly contributions and employer match.

Best Guide to 401k for Business Owners 401k Small Business Owner Tips, Max roth 401k contribution 2025. The average savings account rate as of june 17, 2025, was 0.45%, according to the fdic.

The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2025 to $71,000 in 2025.